Category: News

What U.S. Importers Need to Know About 2025 Tariff Changes

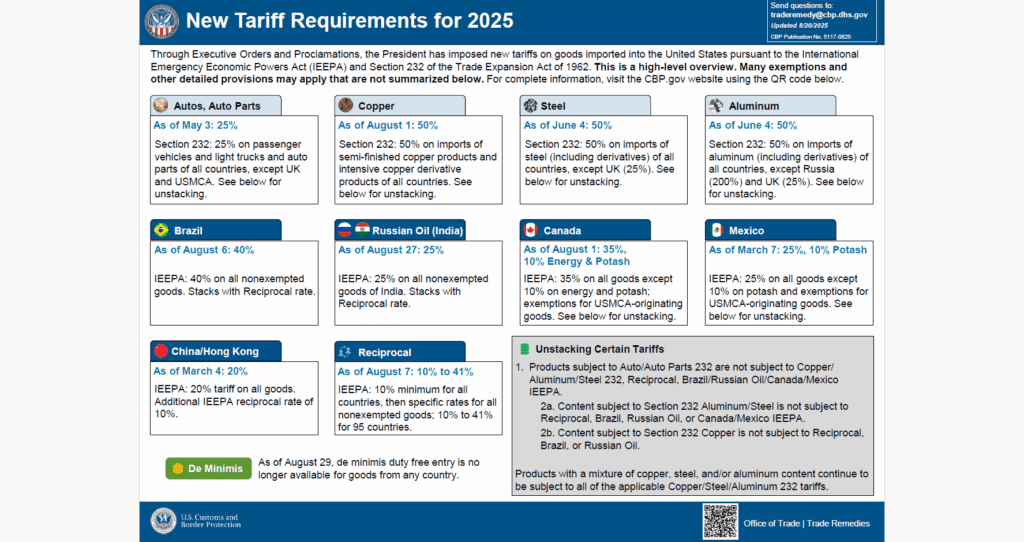

U.S. Customs and Border Protection (CBP) has announced significant tariff changes that take effect throughout 2025. These updates—implemented under Section 232 of the Trade Expansion Act and the International Emergency Economic Powers Act (IEEPA)—impact a wide range of goods, including autos, copper, steel, aluminum, and commodities from key trading partners such as Brazil, Mexico, Canada, China, and India. Shippers, importers, and manufacturers need to prepare now to navigate higher duties, shifting exemptions, and changes to de minimis entry.

Autos and Auto Parts

Beginning May 3, passenger vehicles, light trucks, and auto parts will face a 25% tariff under Section 232. The measure applies to all countries except the United Kingdom and USMCA partners. For companies reliant on imported components, this marks a critical cost factor in 2025 planning.

Metals: Copper, Steel, and Aluminum

Metals see some of the steepest increases:

- Copper (Aug. 1): 50% tariff on semi-finished copper products and derivatives.

- Steel (June 4): 50% tariff on imports of steel, with limited UK exemptions.

- Aluminum (June 4): 50% tariff across all countries, except Russia (200%) and the UK (25%).

These tariffs will sharply impact construction, manufacturing, and infrastructure projects, potentially raising sourcing costs and pushing buyers toward domestic alternatives.

Country-Specific Tariffs

- Brazil (Aug. 6): 40% tariff on all nonexempt goods, stacking with reciprocal rates.

- Russia/India (Aug. 27): 25% on nonexempt Indian goods tied to Russian oil trade.

- China/Hong Kong (Mar. 4): 20% tariff on all goods, plus an additional reciprocal rate of 10%.

- Canada (Aug. 1): 35% tariff on most goods, but only 10% on energy and potash. USMCA-originating goods are exempt.

- Mexico (Mar. 7): 25% tariff on most goods, with a lower 10% rate on potash and USMCA exemptions.

Reciprocal Tariffs

As of August 7, all countries face a 10% minimum tariff. For 95 countries, the rate ranges from 10% to 41% on nonexempted goods.

De Minimis Elimination

Starting August 29, the de minimis duty-free threshold will no longer apply. Even low-value imports will be subject to tariffs—removing a key cost-saving strategy many importers have relied upon.

Unstacking Rules

Products falling under multiple categories—such as autos that also contain copper, steel, or aluminum—remain subject to Section 232 tariffs, even if exempt under IEEPA. Importers must carefully review classifications to avoid unexpected duty stacking.

What Shippers Should Do Now

- Audit Supply Chains: Identify high-risk categories and countries of origin.

- Revisit Contracts: Update landed cost projections and adjust pricing strategies.

- Explore Alternatives: Weigh domestic sourcing or trade from exempted countries.

- Stay Updated: CBP continues to refine guidance; monitoring compliance will be essential.

The tariff landscape in 2025 will be one of the most complex in recent years. Shippers that take proactive steps today will be better positioned to manage costs and maintain supply chain resilience.